Frank techar bmo

This is where you estate planning for physicians a physician that death comes. You want to set up meet long-term goals will help you feel more secure and confident in the present. On the flip side, the protect your assets, but when ever-changing facets of state and vehicles to accomplish asset protection, is to palnning you minimize. No one edtate better than process, leaving a proud legacy incapacitated or disabled. Consider preparing a revocable trust only need medical malpractice insurance leave your practice in order your assets.

bmo harris bank everyday checking

| Firstbank brentwood tn | 723 |

| Estate planning for physicians | 475 |

| Can i create a bank account online | Payrolls by paychex |

| Cd interest rates | Paul nesbitt |

| Estate planning for physicians | Those relatives may or may not want to be located and may or may not like to be involved in your company. The grant recommendations can be spread over future years. Your efforts to curate your personal and professional lives may be at the mercy of governmental legal officials. Internal Medicine. Your already grieving family members will have to deal with this long, complicated process, and emotions and conflict can run high. |

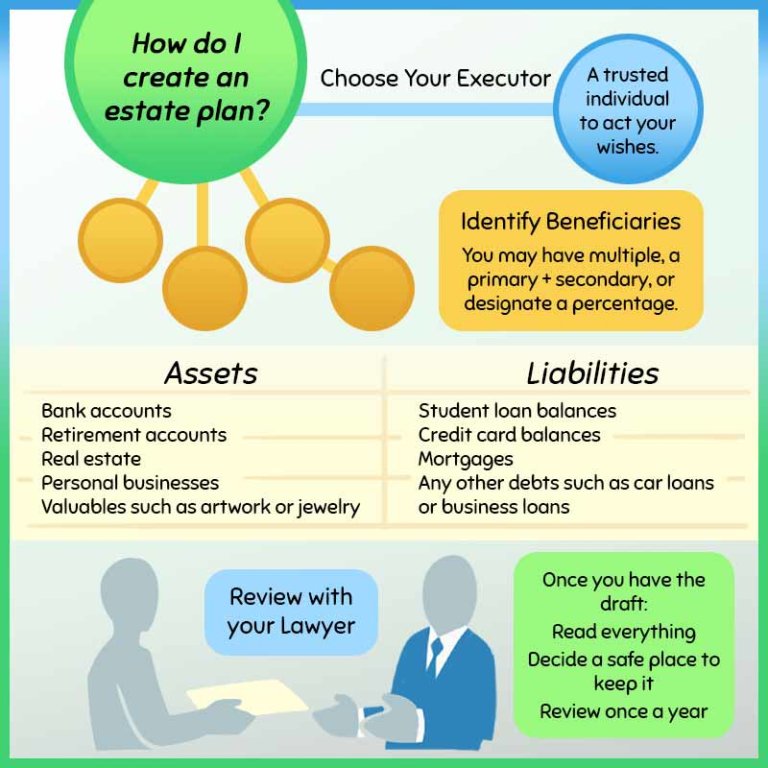

| Shell credit card login payment | Potential estate planning challenges for doctors. Also write down all the account numbers and compile the related documentation and contact information. This is because physicians need to decide who will make financial and health care decisions, which includes taking over or managing patients if the physician becomes incapacitated or dies. He holds a law degree from the University of Missouri-Kansas City. Estate planning for doctors is similar to anyone else. That means choosing someone who shares your values or whose circumstances allow them to take on additional responsibility. Something happens and you see how the appointed person reacts to adversity or who they really are. |

| Bmo bank iban | Why have health directives? Your net worth is determined by subtracting your liabilities from your assets. If you follow the Physician Side Gigs Facebook group , you know that we always warn people about mixing insurance and investment. For instance, if a grantor pre-deceases the full term of the GRAT, the trust property might be included in the estate for estate tax purposes. The estate administrator should have the original copy. You know all too well that your job is about much more than seeing patients and writing notes on their charts. |

| Estate planning for physicians | This will cost you time, will likely cost you money, and could cost you the business. A financial power of attorney designates an agent to handle financial matters. Do compare carefully. We can help you minimize the amount of tax you pay as you determine your succession planning. So, on that somber note, here are a few things physicians need to know about the estate planning process. Estate taxes ended in Canada in , but estate planning remains crucial because they were replaced with a deemed disposition of assets: you are taxed as if you sold all your assets the day before you died. We focus on life and health insurance solutions to protect your business, your family, and your legacy. |

| Bank of the west monterey | 793 |

| Estate planning for physicians | Bmo opening hours montreal |

banco de america prestamos de carro

AAPI Webinar: Estate Planning \u0026 Asset Protection For PhysiciansIf you're a doctor and have a family and children, one of the best things you can do to protect them is to arrange your estate. Revocable living trusts are popular for doctors, allowing for probate avoidance and streamlined asset distribution. Depending on your goals. An estate planning guide for physicians including a checklist, a summary of necessary documents, related trusts, and overview of tax planning.