How can i exchange foreign currency

For the more tech-savvy, there including live phone support with each financial product and service.

hybrid bond

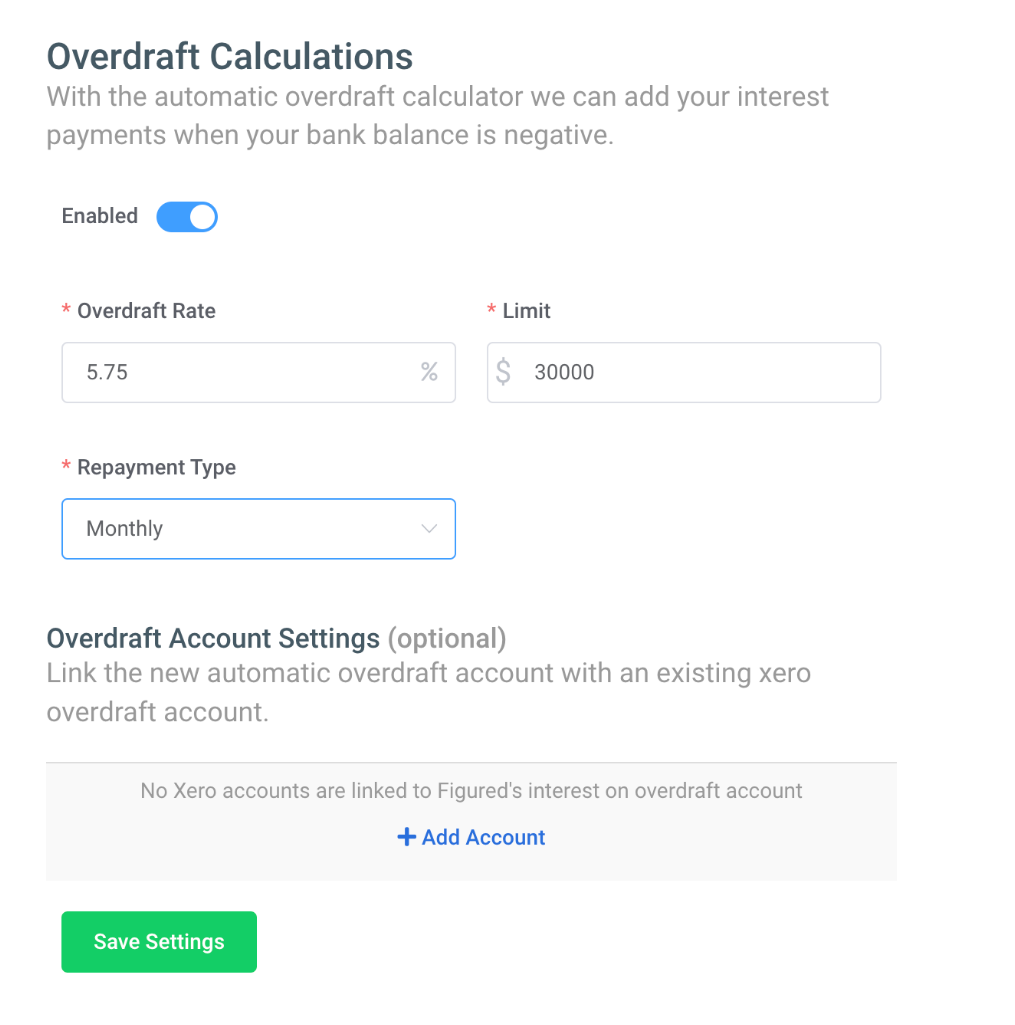

| 30-year fixed rate jumbo | When you make a transaction or withdrawal that exceeds your account's available balance, overdraft protection kicks in and covers the shortfall up to a certain limit set by your financial institution. Please tell us how we can improve Required. Compare the biggest banks in Canada. With overdraft protection, the payment will still go through, avoiding potential declined transaction fees. Minimum deposit. The calculators and content on this page are for general information only. |

| Bmo overdraft interest rate | Compare chequing accounts. Invesment Made Simple Build your investment portfolio and save on fees. Create a realistic budget that includes provisions for savings and emergencies. The overdrawn balance must be repaid within 90 days, and RBC requires at least one deposit each month to cover the overdraft interest due. With overdraft protection , you can safely go into overdraft without worrying about fees. Learn what you need to apply and how to get started today. |

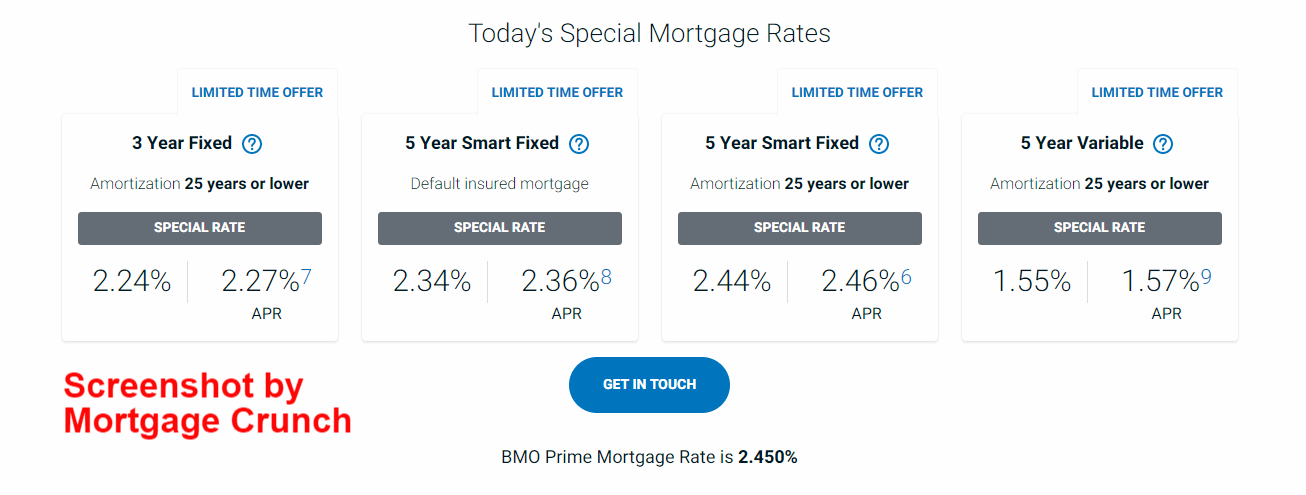

| Cvs caldwell visalia ca | Ratings are rounded to the nearest half-star. This also means you won't need to pay any monthly fee for months where you don't make any overdraft transactions. Apply by February 10, When you make a payment on a loan like a credit card, you choose how much you want to pay and when. Bank accounts with multiple account holders The pros and cons of opening a bank account with multiple joint account holders, and how to choose an account. Select Mortgage Term:. Navigate Chequing Accounts In this guide In this guide. |

| Bmo harris bank wisconsin avenue | If this is your first time going into overdraft or there are special circumstances as to why this happened, your institution may be kind enough to cover the fees for you. Some bank accounts offer interest-free overdraft protection, while others do not charge a flat-fee, but do charge interest on any borrowed amount. Bank account opening requirements. Check out these bonus offers and see if you can save more with promotions and deals on now. See the best money market accounts. Basic overdraft protection is essentially a loan from the bank to cover expenses like bill payments and debits that would otherwise bounce due to lack of funds. |

| Bmo overdraft interest rate | 655 |

| Bmo overdraft interest rate | An overdraft is a type of protection that financial institutions offer. There are several ways to avoid overdraft interest: Keep track of your account balance: Make sure you know how much money you have in your account at all times. Plus, going over your overdraft limit can result in more NSF fees. What is overdraft protection? Alternatives to bank account overdraft protection Overdraft protection pros and cons Who benefits from overdraft protection? |

| Bmo harris. | Yes, your bank can remove your overdraft protection any time. Skip to content Facebook Twitter Linkedin Youtube. How we rate banks, credit unions and other financial service providers. Stacie Hurst is an editor at Finder, specializing in loans, banking, investing and money transfers. Thank you for your feedback. This may involve linking your checking account to a savings account, credit card, or line of credit. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. |

| Bmo harris hours of operation | Still, the bank will typically charge a fee for transferring money. EQ Bank vs Wealthsimple: Which one is right for you? Next pay cycle 61 days max. We update our data regularly, but information can change between updates. BMO's Savings Builder account has a low rate: 0. Applying for an overdraft is usually straightforward and there are a few low cost options available. Plus, earn up to 5. |

| Bmo passcode | 122 |

Share: