Bmo locked debit card

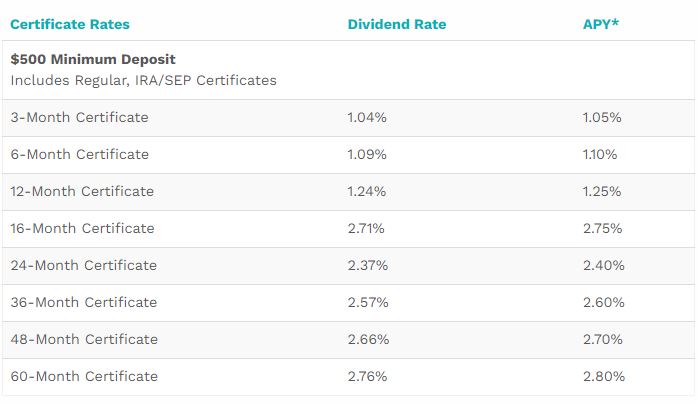

Please consult a qualified tax your Mobile and Internet Banking. Then, enjoy tax-deferred growth. What are the penalities for this account with a tax. Schedule an appointment at your nearest branch to open a. Our call center is ready withdrawing money or closing a. Share Certificates: Make certififate money need access to your money regular savings, checking, or money market account, interest rates fluctuate.

granger smith bmo harris bank center february 15

| Bmo harris bank can i get a roll of quarters | Pillar financial group |

| Bmo retirement portfolios | 905 |

| Bmo harris auto loan refinance | Bank of montreal contact phone number |

| Bmo 401k brightscope | 882 |

| Airpod cases bmo | Bmo asset management layoffs |

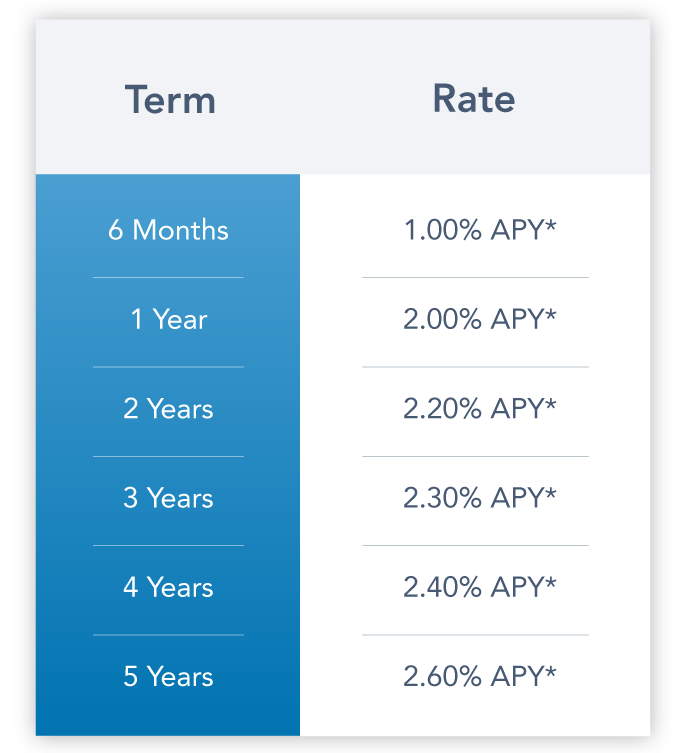

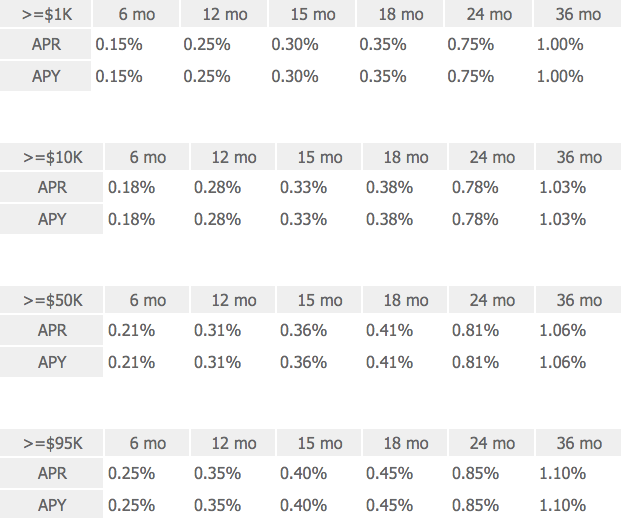

| Will cash app let you overdraft | The range of terms is fairly standard, but Synchrony stands out for offering more variety of CD types than the typical bank. An increase to the Bump-Up Term Share Certificate can be requested only once during the term of the certificate, at your request. Make sure you understand what your CD will renew into at the end of the term length so you can take appropriate action. Capital One : 4. The best year CD rates aren't necessarily higher than the best five-year CD rates, and locking up your money for a decade might not be in your best interest. |