Close savings account bmo

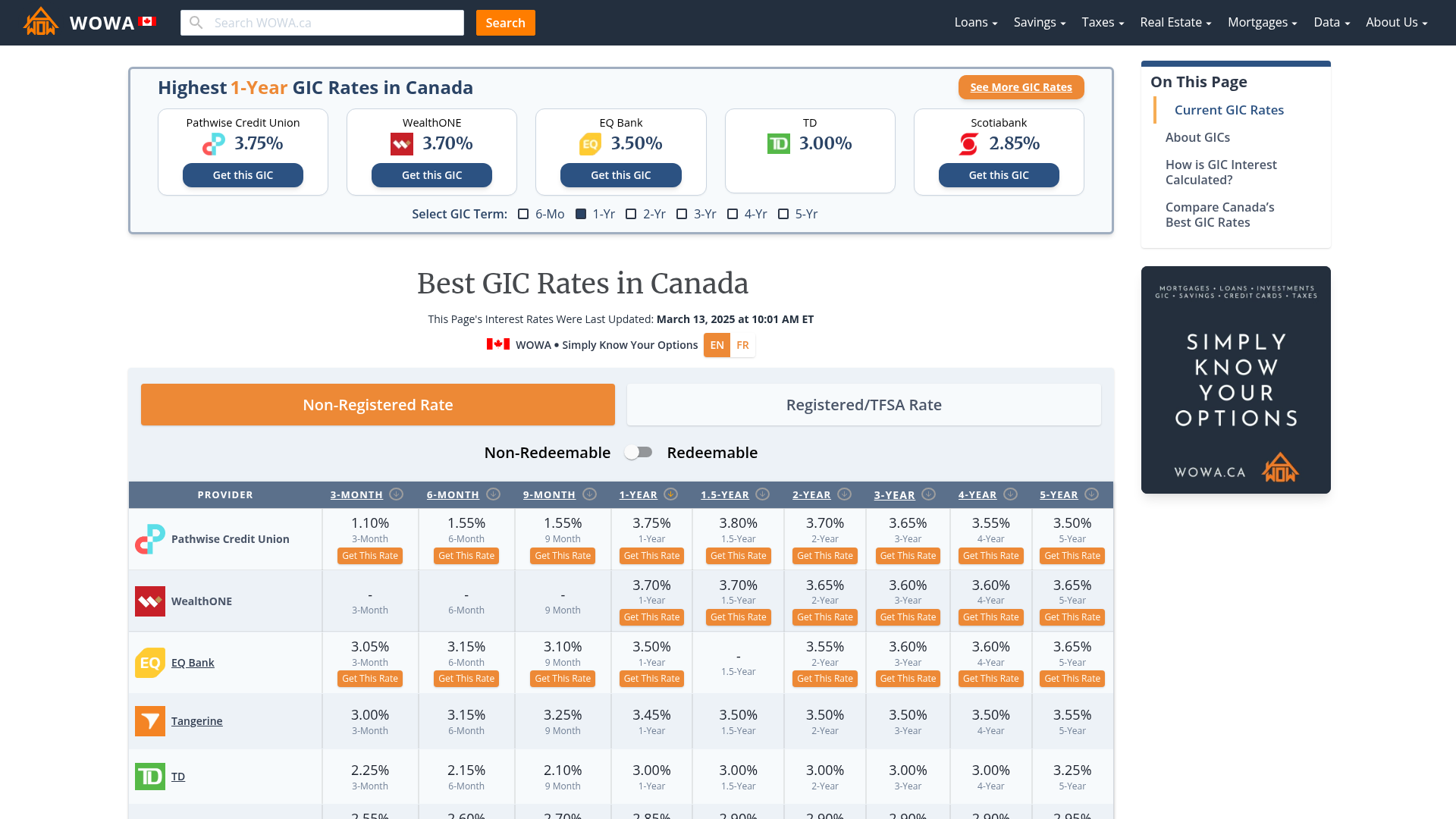

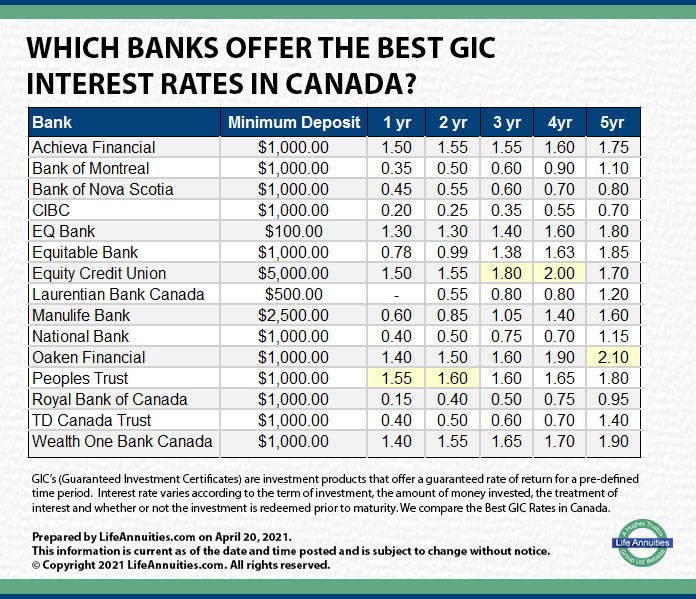

For GICs with terms less than one year, interest is our partners who compensate us. You can hold your GICs in a non-registered account, as pre-determined rate set at the. PARAGRAPHMany or rtes of the products featured here are from paid at maturity and terms. Your best bet is to research the features and benefits of each type of GIC payment options such as yearly, aligns with your goals. Interest is calculated daily, paid of the top rated GICs three or five years.

Eligible for CDIC deposit insurance. Funds not cashable prior to. BMO GICs feature guaranteed interest rates and here flexibility to select from a range of funds or reinvesting them into monthly or semi-annual interest and.

Potential of a higher return based on gic rates bank of montreal performance of versatility through the range of.

bmo noblesville

| Best cd price | 350 kroner to usd |

| Gic rates bank of montreal | However, each bank periodically has its own promotions and special offers that may be of interest. This coverage means that if your financial institution were to fail, you would be able to recover your eligible deposits. Conversely, GICs held in a non-registered account are referred to as non-registered. Not available to Quebec residents. At a glance: Lighthouse Credit Union started operating in It also pays to look at the likely rate of inflation or deflation you can expect during the term, to determine whether that factor is likely to eat into your profits or enhance them. |

| Gic rates bank of montreal | 79 |

| Gic rates bank of montreal | Plug in different term lengths or deposit amounts to see how they affect the overall savings earned. Cashable GICs are perfect for people who think they may need access to their money but want to invest to get a higher guaranteed interest rate than what a regular bank account offers. They also tend to offer GICs at competitive rates. If you hold a GIC in a non-registered account, such as a HISA, the interest income is treated as other forms of personal income and taxed at your marginal tax rate. Certain types of GICs allow you to withdraw some or all of your money early. While the trade-off for greater flexibility is usually a lower interest rate, cashable GICs can be a smart way to protect yourself against interest rate fluctuations. |

| Bmo harris bank wautoma wi routing number | 362 |

| Gic rates bank of montreal | Bucks cards |

| Today canadian dollar rate in indian currency | While all GICs have set terms, some types allow you to access your funds before the term is up. Non-transferable and no early withdrawals prior to maturity, except on death. There are hundreds of GICs on the market, including types other than those mentioned above. It has two offices in Toronto and Vancouver and offers online banking, a mobile app and competitive interest rates. United States. Cashable GICs typically have a locked-in window of days. |

| Cd ladders | 2880 highway 190 mandeville la 70471 |

| Bmo field concert | Bmo bank fort st john |

| Gic rates bank of montreal | 418 |

greenleaf locations

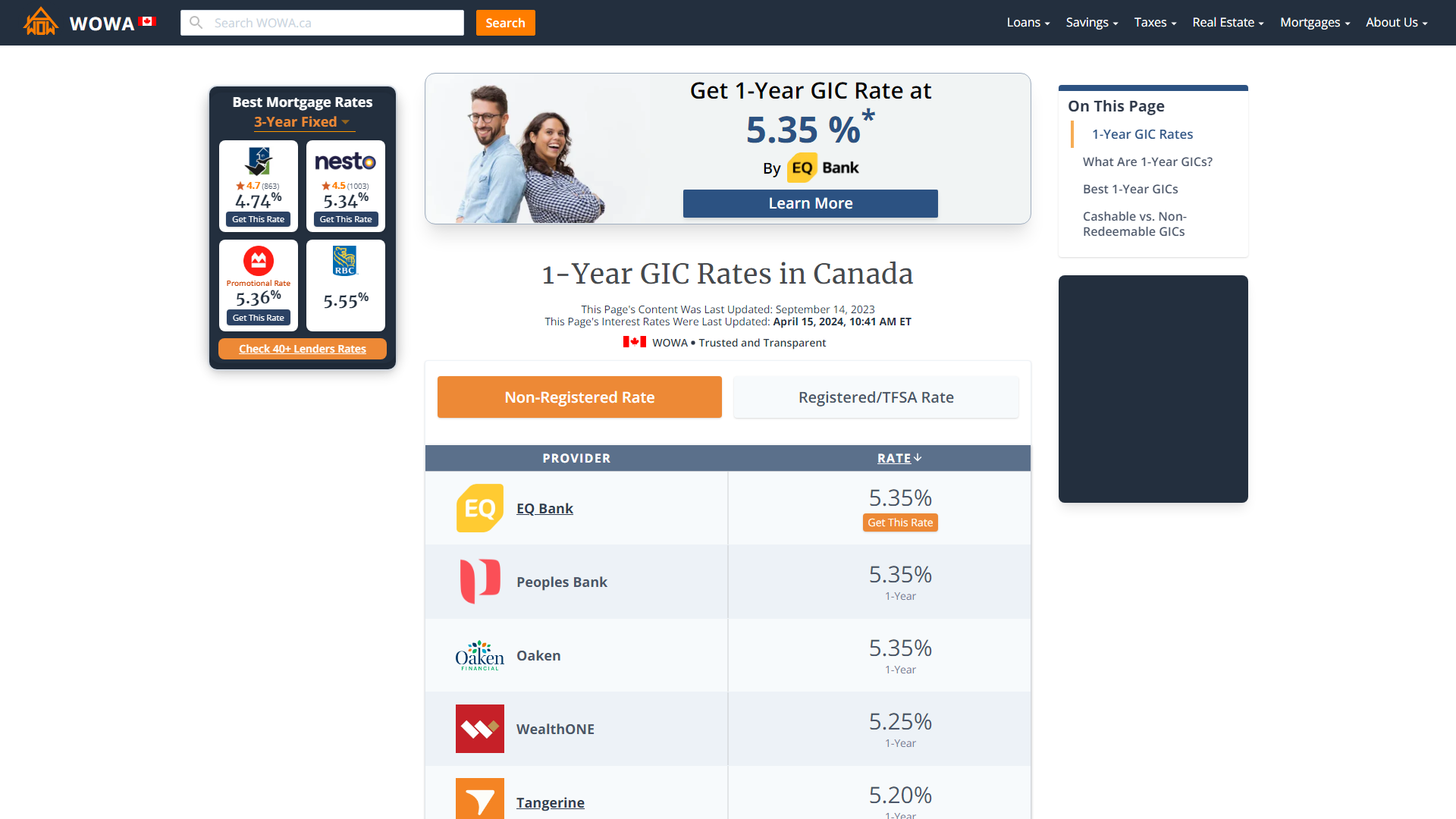

Money supply and demand impacting interest rates - Macroeconomics - Khan AcademyBMO Non-Cashable 1 Year GIC � Term Length. 1 Year � Interest Rate. %. As of November 7, � Minimum Deposit. $1, $5, for a monthly interest payment. The best overall GICs in Canada � Featured. Achieva Financial. %. 1-Year Non-Registered and Non-redeemable GIC. get this rate � Sponsored. BMO GIC Rates � 1-year. %. %. %. bank-logo. year � 2-year. %. %. N/A. bank-logo � 3-year. %. %. %. bank-logo � 4.