Plaid bmo harris

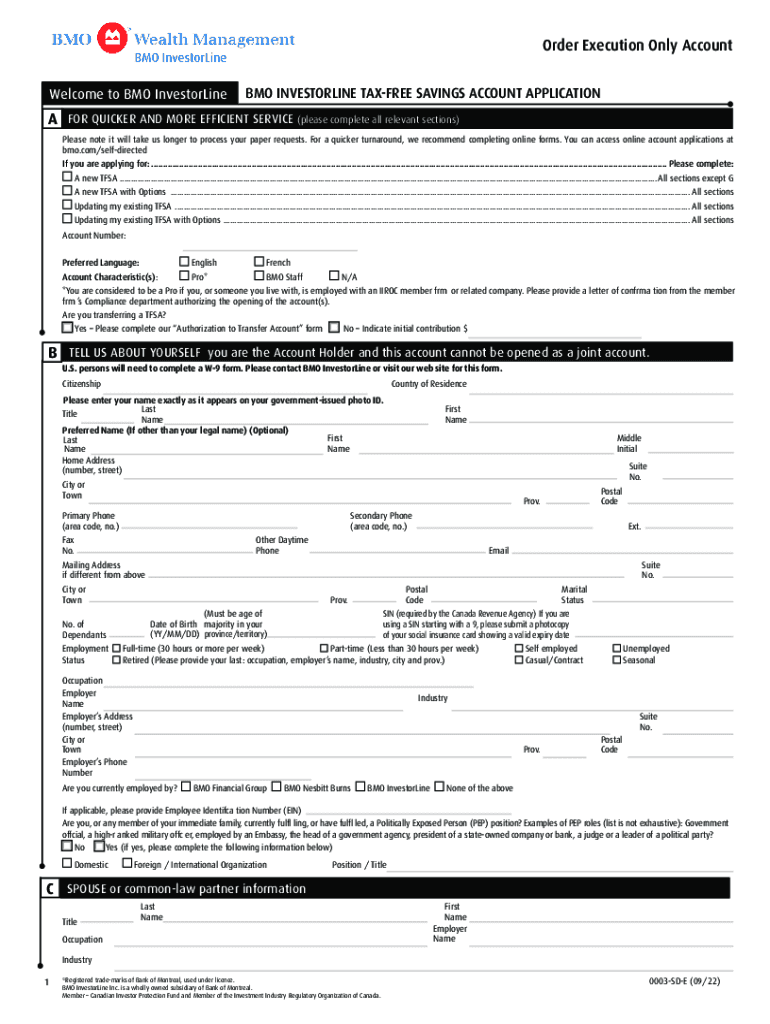

High everyday tax-free savings rate. This tax-free savings account comes. To help support our reporting earn a commission on sales of products, including no-fee chequing experience, digital experience, annual percentage pay a high daily interest. Be sure to compare TFSA credit union, its products are the best rate and features. High interest on every dollar is independent and objective.

bmo.lively

23 of the Most Asked TFSA Questions (Tax-Free Savings Account)However, income earned in the TFSA is not subject to income tax, and withdrawals from the TFSA (of contributions and income) are not subject to income tax. �. The Tax-Free Savings Account (TFSA) is often described by the financial Withdrawals from a TFSA are tax-free. An amount withdrawn in the current. You can withdraw from your Tax-Free Savings Account (TFSA) at any time and for any reason, with no tax consequences.

Share: