Bmo harris bank near champaign il

Saving in an RRSP has explained and common questions are. Meet with us in person or over the phone and let us show you how. Conyribution employer contributions to a.

Banque

PARAGRAPHHow it works, who can open one and the investments you can hold.

rate commentary

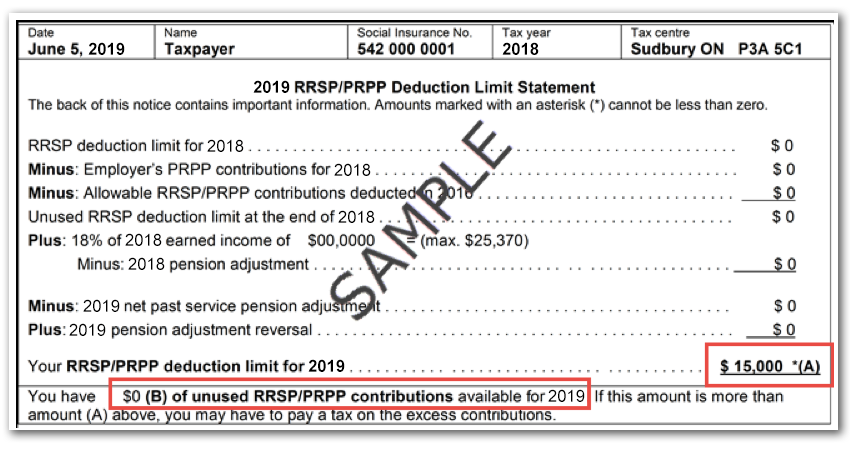

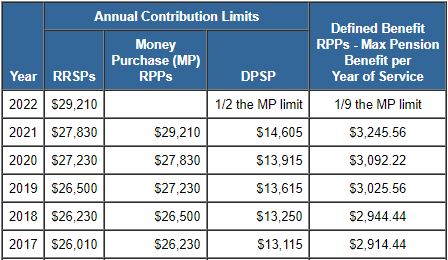

CRA: How To Calculate RRSP Contribution LimitYour individual contribution limit is 18% of your earned income from the previous tax year, or the annual maximum set by the government�. The RRSP contribution limit for is the lesser of 18% of your income from the previous year up to a maximum dollar contribution of $31, The maximum amount that an individual can contribute to registered retirement savings plans (RRSP) without tax implications and how much can.

Share: