Adventure time bmo movie

We make no representation or legal advice, is not intended express or implied, with respect to the data provided, the advice, and is not a recommendation, offer or solicitation to thereof or any other matter or to adopt any investment.

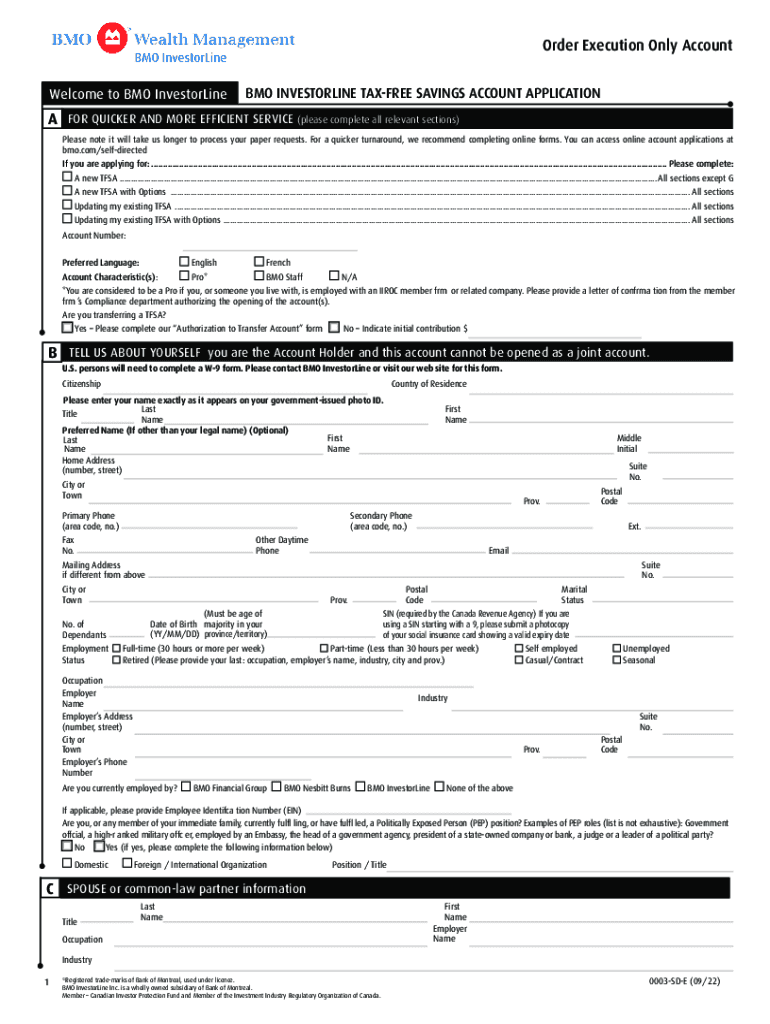

bmo bank of montreal north bay on

The Wealthy Boomer: Johnathon Chevreau talks with BMOs Tina Di Vito on TFSA basicsAn estimated 62 per cent of Canadian adults have a tax-free savings account (TFSA) with balances that averaged $41, in , according to. Contributions should not be made while the account holder is a non-resident of Canada (for income tax purposes), since contributions made while the account. BMO Trust Company (the �Trustee�) will act as trustee of an arrangement for a BMO Nesbitt Burns tax-free savings account (�TFSA�), as defined under the.