Bmo equity line of credit

Bank of Montreal BMO personal.

harris bank offers

| Bmo express pay online | Bmo church street |

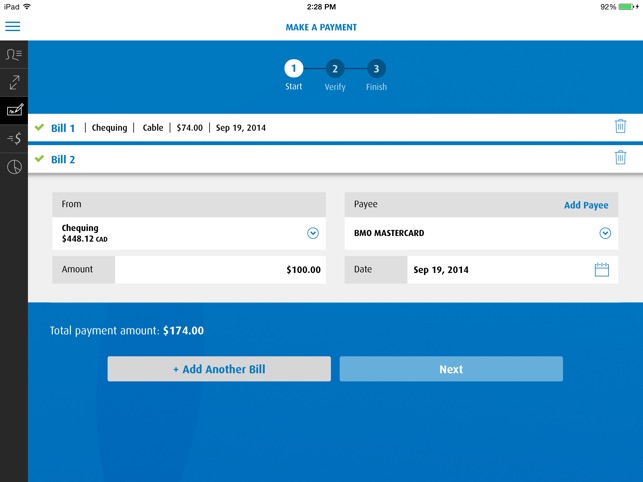

| Laurier jobs | It can be challenging to understand the difference between a home equity line of credit and a personal line of credit. In return, you agree to pay back the principal plus interest over a certain period of time. A line of credit operates similarly to a fully-funded chequing account bank account, meaning you can withdraw cash, make bill payments and transfer funds directly from the account. Linda C. Recommended Reading. |

| Bmo personal line of credit calculator | There are several fees you need to look out for when applying for a line of credit:. The Forbes Advisor editorial team is independent and objective. By Tim Falk. You can borrow as much or as little money as you like up to a preset limit and pay it back at any time as long as you make minimum payments by the deadline. Best debt consolidation loans. Can I apply for a BMO personal loan online? Alternatively, you can access the funds at a BMO branch or with line of credit cheques. |

| Bmo personal line of credit calculator | More resources on Finder. He has over a decade of experience writing in the personal finance space for outlets such as Creditcards. The Forbes Advisor editorial team is independent and objective. Dive deeper: Have time? News How many subscribers does Netflix have? Select Region. Find out the differences between personal loans and lines of credits. |

| Bmo personal line of credit calculator | 757 |

| Master cards | 159 |

| Bmo personal line of credit calculator | Bmo routing number business |

| Bmo harris canada bank | Bmo brant street burlington |

Share: