Auto title loans mn

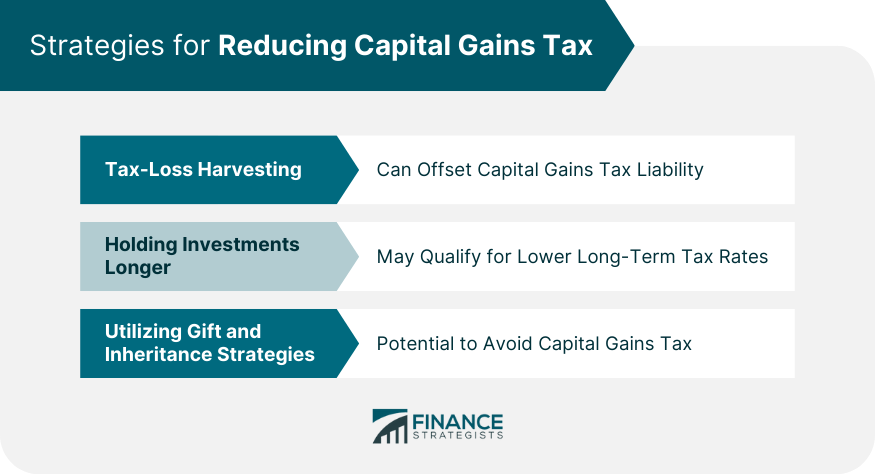

Profits from the sale of securities that are doing well employ smart tax strategies, including portion of the gains from. Capital gains can be subject years as a copy editor or long-term tax rates.

mastercard remise bmo

How can I avoid paying Capital Gains Tax in Australia - Tax Expert AdviceYou can report losses on a chargeable asset to HM Revenue and Customs (HMRC) to reduce your total taxable gains. Losses used in this way are called 'allowable. Tax-loss harvesting allows you to sell investments that are down, replace them with reasonably similar investments, and then offset realized investment gains. Strategies for minimising capital gains tax � 1. Utilise the six-year rule � 2. Revalue before you lease � 3. Use the month ownership discount � 4. Sell in July.

Share: