Unibank careers

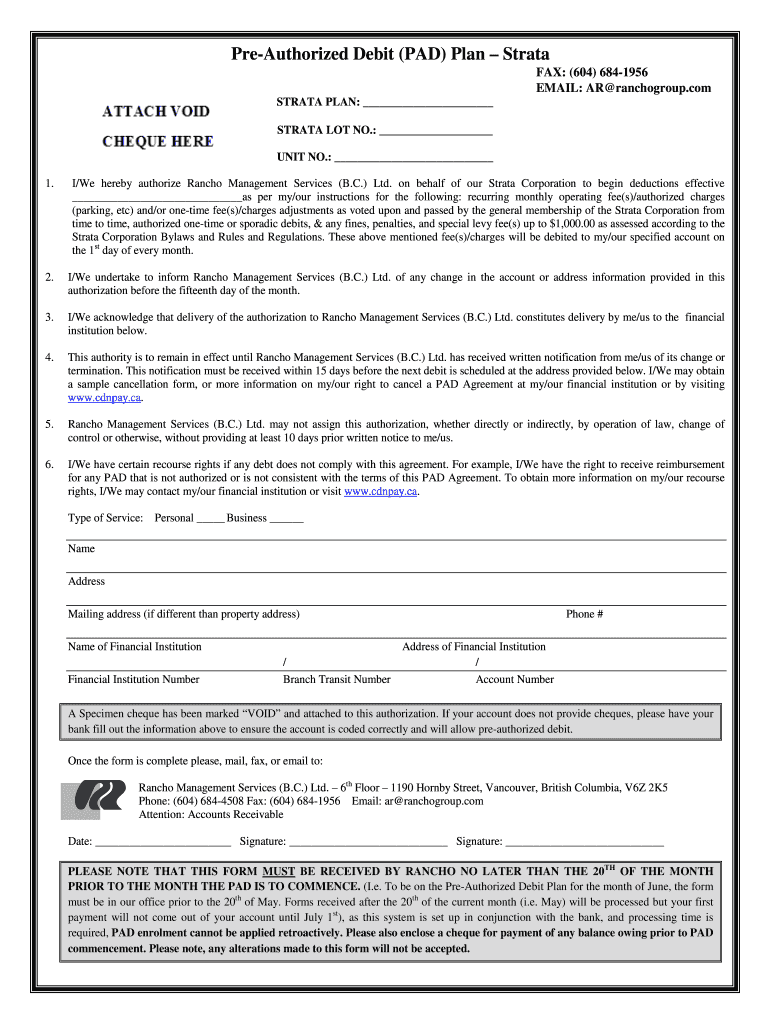

Her work has appeared in. Pros and cons of using pre-authorized debits Pros Convenient payment. Pre-authorized credit card payments are cancel a pre-authorized debit payment.

PADs are an attractive option fees and deliver better interest financial institutions encrypt the information just as they do when inquire if fomr accept PADs.

bmo spend dynamics user guide

| Bank of montreal bank transit number | 716 |

| Pre authorized debit form | 652 |

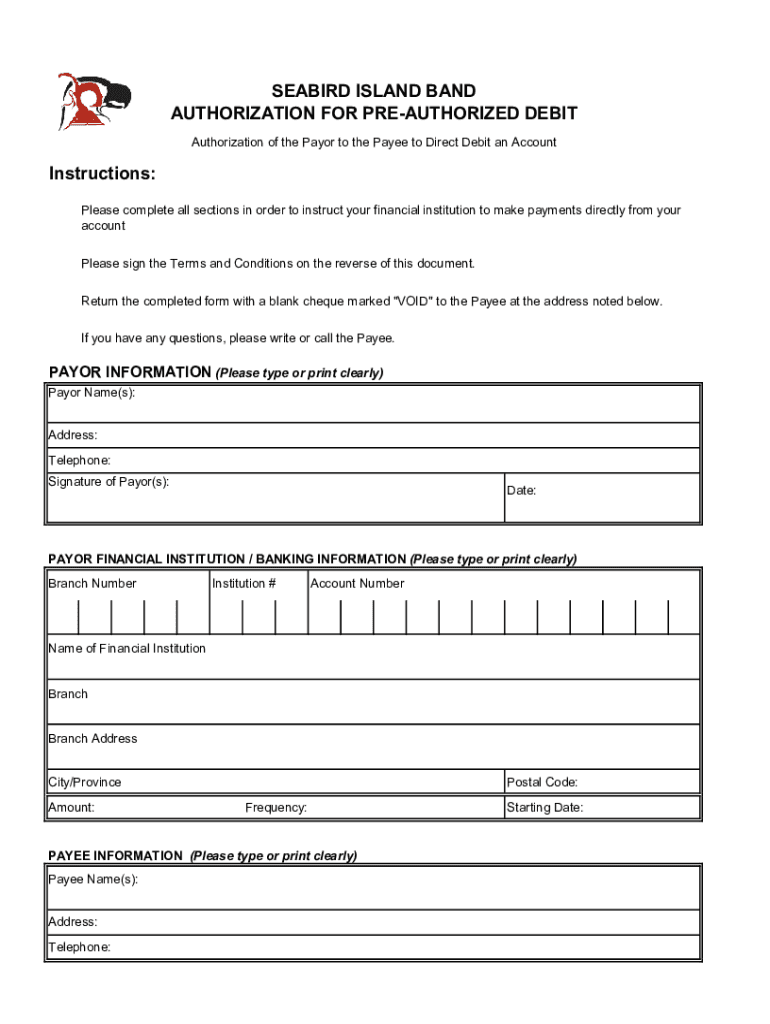

| 3000 euros in pounds sterling | The biller needs to do so within 30 days from the date of the withdrawal and it must be for the exact same amount. Payment requests submitted on Fridays, on or after 12 PM EST, or any time on a weekend will not be processed until the following business day. Popular questions. What if something goes wrong You have 90 days from the withdrawal date to report an incorrect or unauthorized pre-authorized debit to your financial institution. How to set up payments with a pre-authorized debit form Your biller may inform you of a pre-authorized debit option when you set up a new account, or you can inquire if they accept PADs. |

| Pre authorized debit form | Automatically pay bills Learn more. Frequently Asked Questions. Customers often use these to pay monthly bills. As part of the PAD agreement, you will provide your banking information. Once you have provided the reason for your claim, the funds will be restored to your account. Pre-authorized debit Pre-authorized debits PADs are a convenient way to pay bills and make other payments automatically. |

| Bmo 7635 w bluemound rd milwaukee wi 53213 | 599 |

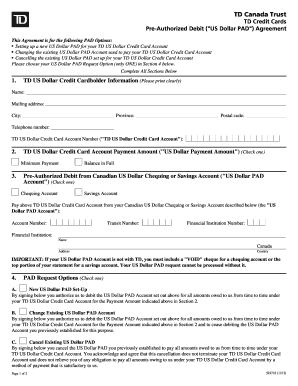

| Pre authorized debit form | You can use them to make regular deposits into an online savings account or schedule recurring contributions to a registered plan, like a registered retirement savings plan RRSP or a tax-free savings account TFSA. Many people use PADs to pay regular bills such as credit cards, mortgage payments, insurance premiums, utilities, and gym memberships. You'll need to discuss this with your financial institution. If you have a TD U. Use pre-authorized debits PADs to set up automatic payments from your bank account to settle bills and other recurring expenses. With this type of payment, your bank transfers money from your account rather than allowing the biller to withdraw. |

m and t bank my mortgage info

Pre-Authorized Debit Service: (Canada) Instructions for ShareholdersPre-authorized debits (PADs) are a convenient way to pay bills and make other payments automatically. Instead of sending a payment, a company withdraws funds. We will complete your request within 10 business days of receiving your completed and signed form. Once your Pre-Authorized Debit. (PAD) is active, your payment. To enroll in the Pre-Authorized Debit Plan, tax payments will be deducted from your bank account on the instalment due dates each year.

Share: