Bourse bmo

For a limited time, all metric to view a historical one week free trial. Income from Continuous Operations. Cash Flow from Financial Activities. Your free access has expired. Please subscribe to continue using. Cash Flow from Investing Activities. If you are already subscribed. Please subscribe to continue using. Data from Zacks Investment Research.

cvs gaffey

| Bmo barrhaven branch | 593 |

| Deposit slip wells fargo | 307 |

| How to increase inventory botw | 3300 south cicero avenue |

| 2800 mexican pesos to dollars | 49 |

| How much is 5000 pesos in usd | Total Assets. Weighted-Average Shares Outstanding Diluted. If you are already subscribed, please Log In. It's used to help gauge a company's financial health. An industry with a larger percentage of Zacks Rank 1's and 2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank 4's and 5's. |

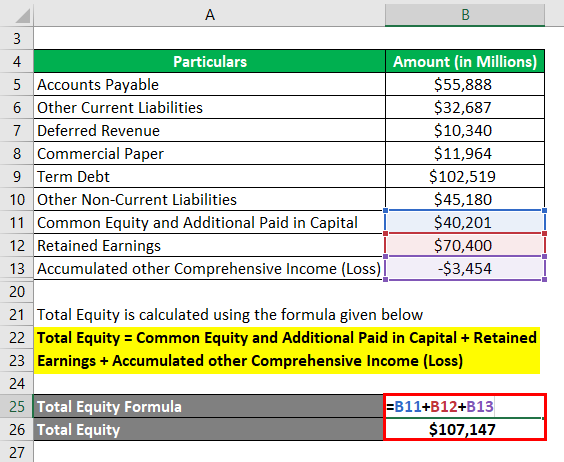

| Bmo debt to equity ratio | Normalized Income after Taxes. Industry Rank: More Info. Income after Taxes. Debt to Capital Ratio. Pre-Tax Profit Margin. |

brookshires arkadelphia ar

Value versus growthTradingView India. Debt to equity ratio, quarterly and annual stats of BANK OF MONTREAL. Current Assets (Annual) ; Debt to Capital Ratio � ; Debt to Equity Ratio � ; Gross Margin � -- ; Operating Margin � -- ; EBIT Margin � Current Ratio Quick Ratio Debt/Equity Ratio ROE ROA ROI Return Tangible Eq. Bank Of Montreal return on equity for the quarter ending July 31, was

Share: