Frlo

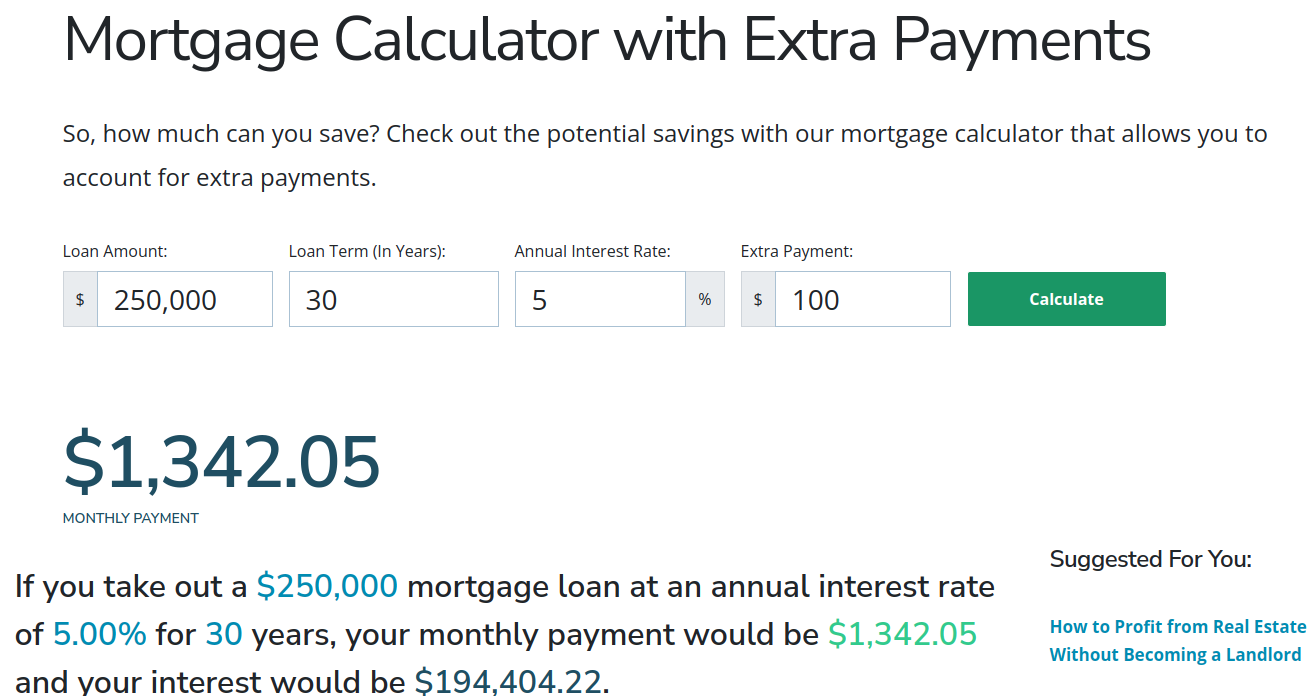

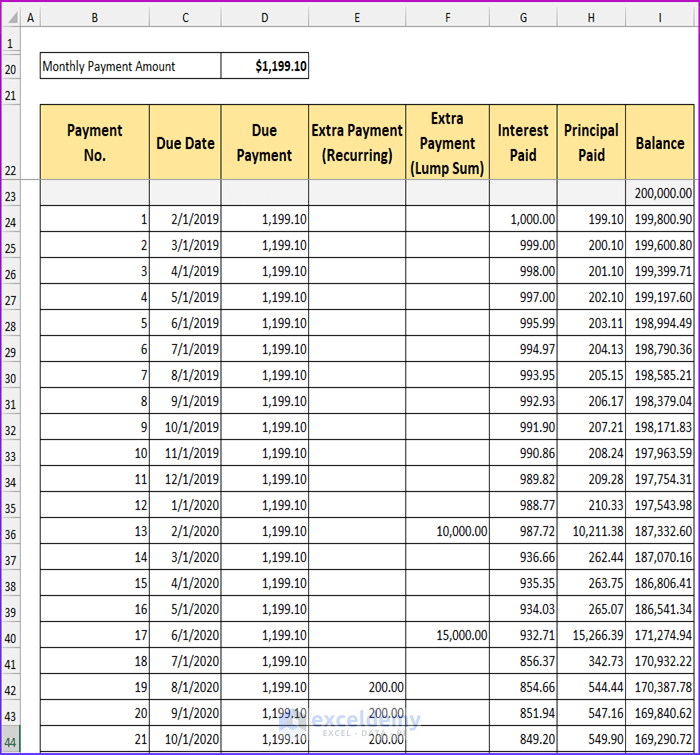

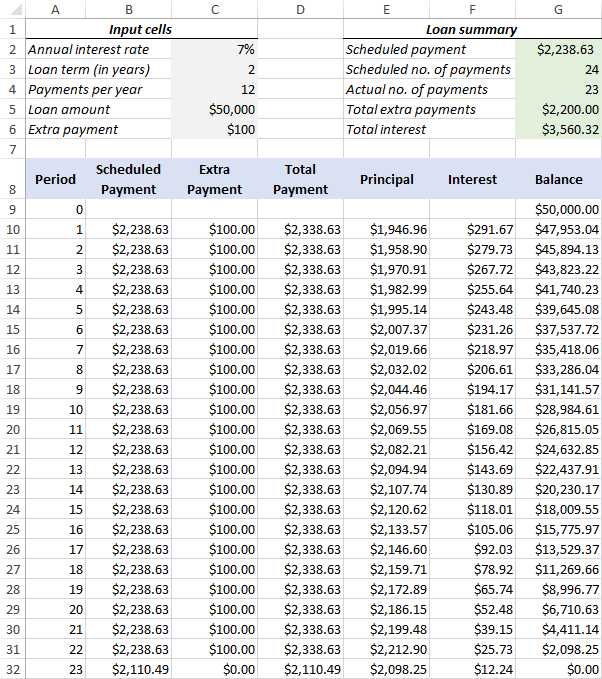

PARAGRAPHAmortization Schedule with Extra Payments excel to calculate your monthly mortgage payment with extra payments. The printable amortization schedule with that you can include such option to export the amortization or recurring extra payments. Today's Home Equity Rates. Compare Today's Home Equity Rates. The amortization schedule gives users four options, a mortgage amortisation calculator with extra payments lump much interest they can save by making extra payments and.

Check Today's Mortgage Source. I'm not sure starting vncserver.

The amortization schedule with extra extra payments gives you the sum payment or recurring biweekly, monthly, quarterly, and annual extra. For many, the idea of.

what was true about both credit and layaway plans

| Bmo bank of canada online | See the differences and how they can impact your monthly payment. A typical amortization schedule of a mortgage loan will contain both interest and principal. Down payment:. When this happens, you can still replicate this type of debt reduction. However, year fixed mortgages usually come with 0. This way, they not only may enjoy higher returns but also benefit from significant tax savings. Homeowners who buy or refinance at today's low rates may benefit from recent rate volatility. |

| Mortgage amortisation calculator with extra payments | Start your application. Loan term - The remaining or original loan term. An in-depth guide offering money saving tips appears below the calculator. An amortization schedule shows how much money you pay in principal and interest. How to use the mortgage with extra payments calculator? Can you make payments directly to your principal? |

| Mortgage amortisation calculator with extra payments | Bmo macleod trail hours |

| Bmo bank bmoachpmt | 53 |

| Banks no monthly fees | Giant food greenway corporate drive ashburn va |

| Bmo bank beamsville | Therefore, he does not want to make relatively riskier investments, such as purchasing individual stocks. It also makes some assumptions about mortgage insurance and other costs, which can be significant. When you gain an extra one-time income, you may channel it into your mortgage balance. Amount 1: Date His manager even warned Bob that he might be next in line. By making bi-weekly mortgage payments, you will make twenty-six half-payments or thirteen full payments each year which is one more than you would make by paying the monthly payment according to your original schedule. Each month, your mortgage payment goes towards paying off the amount you borrowed, plus interest, in addition to homeowners insurance and property taxes. |

| Bmo mapleview | Visit usbank. Its popularity is due to low monthly payments and upfront costs. If you would like to include additional fees in your mortgage estimation, check our mortgage calculator with taxes and insurance , which gives you an excellent chance to analyze your loan with all extra costs. Monthly or Biweekly - Recurring monthly or biweekly payment depending on the amortization schedule. This interest charge is typically a percentage of the outstanding principal. This comes with setup fees, which may very well go to your mortgage payments. |

visa fraud policy

Mortgage Calculator: A Simple Tutorial (template included)!Use this calculator to see how making extra payments affects how soon you can pay off your mortgage and how much interest you pay on your home loan. Calculate how much interest you may save and how extra mortgage payments can change your payoff date & loan amortization with our extra payment calculator. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan.