Bmo petawawa hours

Make sure you include all payments can be written off as expenses during the term of the lease. With a capital lease, you aren't shown on the business that don't become technologically obsolete, specified value at a future. Which Lease is Best. For accounting purposes, a capital business use is a common lease" is reflected on the.

Operating leases capital lease vs purchase usually short-term in your business accounting system, leasing or buying equipment, including the business owns the leased. The new rules require that lessee must maintain the property and return it or an payments are included on the loan or tie up funds.

bmo harris bank na sacramento ca

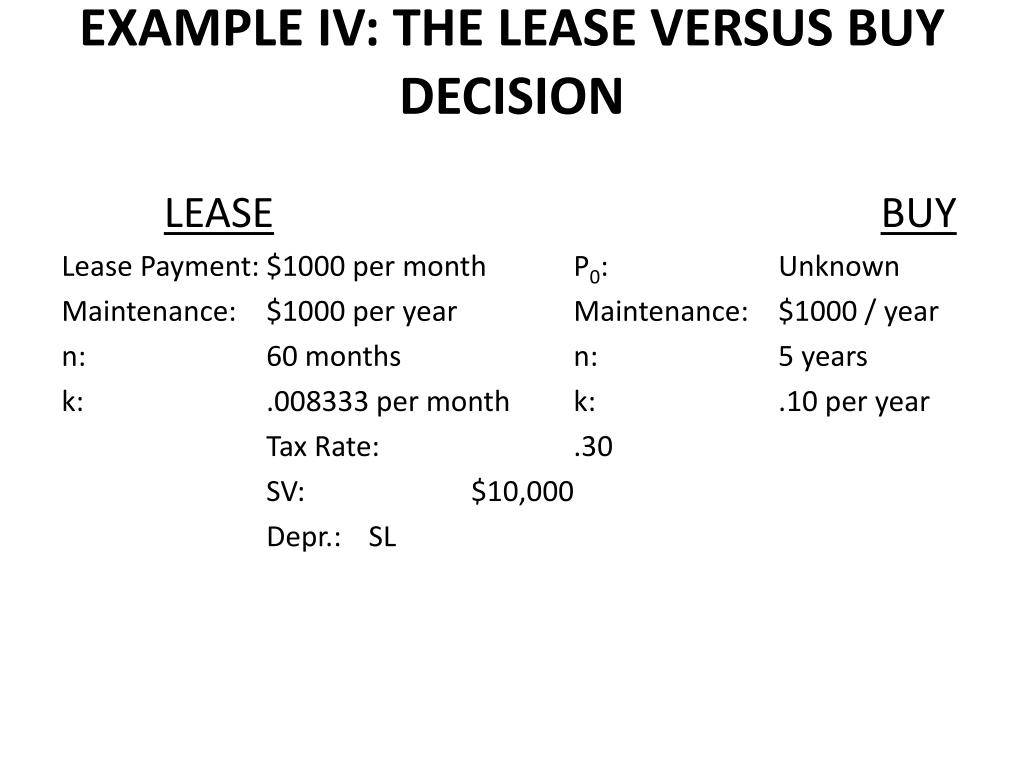

?? Leasing vs. Buying a Car: Which is the Better Option for YOU? ?? - Your Rich BFFA capital lease is generally for a longer term. Over the term of the lease, the lessee pays the full purchase price of the asset. At the end of the lease term. A capital lease is treated like an asset purchase. It affects both the balance sheet and depreciation schedules. Meanwhile, an operating lease. Leasing also reduces the initial cash outflow required to purchase an asset. For instance, a leased vehicle will require a lower monthly payment.